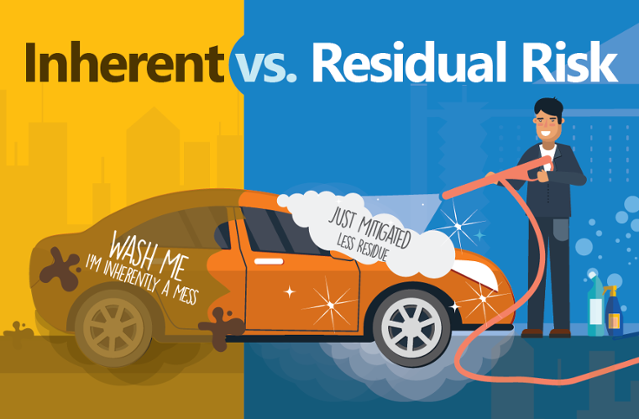

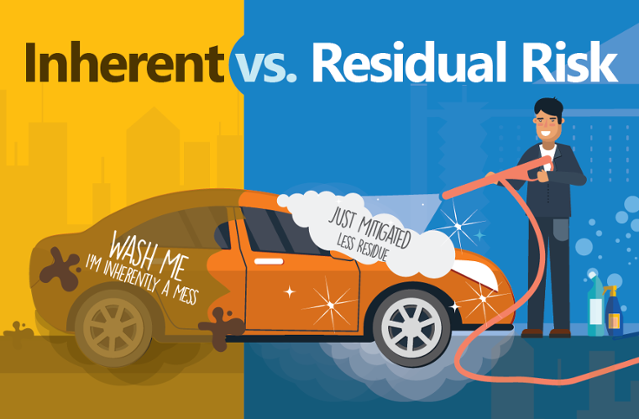

The inherent risk is the amount of risk or risk rating that depicts the total risk a vendor could potentially pose to your organization. Inherent risk is the risk posed before any controls are put into place to get to a residual risk (remaining risk).

We get to this conclusion, generally, by asking a small set of risk-driving questions, such as:

- Does (or will) this vendor have access to sensitive data?

- Will the vendor be integrated on our platform?

- Will the vendor interact with our customers?

- Does the vendor provide a key service to us?

Once you know your inherent risk, a decision needs to be made on whether that risk is acceptable. If your inherent risk is low, then your residual risk is also low, and maybe you’re okay with not doing anything more. However, if your inherent risk is high, that’s exposed risk to your organization and you’ll want to handle it appropriately by mitigating, transferring, avoiding or officially accepting the risk.

After asking the above questions to determine the inherent risk, measures can be put in place to protect your organization from that risk. After taking those measures and considering any controls the vendor has in place, you’re then left with the remaining risk.

Four Ways to Handle Inherent Risk

Here are four ways to handle inherent risk to get to the residual rating:

1. Avoid It

Like abstinence, the most effective way to reduce risk is to avoid it altogether. Now, I know we said that you can never have less inherent risk than residual, so with vendor management, what we can do after conducting the inherent risk assessment is ask ourselves and/or our line of business vendor owners if all elements that contribute to the inherent risk are actually necessary.

You might ask yourself the following questions:

-

- Do we need to send our entire customer file or just certain portions?

- Do we need to use email or can we establish a secure VPN?

- Do we need to allow their personnel access to our facilities or provide them credentials to our system?

There are a lot of little ways that your vendor risk assessments can assist with avoiding unnecessary risks when establishing vendor relationships. This is especially true when we have clear and effective ongoing internal communication with the appropriate stakeholders. Having some good risk-based training in your organization would also be a great way to help everyone do their part in risk avoidance.

2. Mitigate It

This is what we talk about most often with vendor risk assessments as it involves the implementation of controls – or moreover, identifying controls that are already in place, as part of conducting vendor due diligence.

A control could be an action, process, strategy, task or requirement that aims to “prevent” and/or “detect”. Here are two examples:

-

- Preventative Controls: These are intended to deter or prevent bad things from happening. They can include actions like requiring authorizations, appropriate separation of duties or principal of least privilege, maintaining good physical security, etc.

- Detective Controls: These are essentially intended to catch or detect when something bad has happened. Examples would be activities like access reviews, reconciliations, audits, taking inventories, etc.

Reach out to vendors, get a feel for their internal policies, processes, procedures and understand their control environment that has to do with the risks exposed to your organization. Prevention and detection are both essential and should be common practice. Not only do you want to be sure vendors are working to prevent risk, but they also need to be testing those controls by having good detective measures in place and avoiding any unnecessary loss or negative impact.

3. Transfer It

To transfer risk is exactly as it sounds. You’re not exactly alleviating the risk, necessarily, but you’re transferring the financial or legal liability to your insurance carrier or to your vendor. The best examples of this in vendor risk management would be by contract indemnification or ensuring adequate insurance policies are in place.

4. Accept It

This, of course, should usually come as a last resort. The point of risk management is to understand risk. But, there will be times when there is risk that can’t be mitigated. It’s a normal and regular part of business, as we’ve all heard the phrase, “with great risk comes great reward...” The point is to make sure that your leaders are aware of pertinent risks posed by the vendor environment and are able to make informed decisions on whether or not to accept it. Also, remember that any and all unidentified and ignored risk is also accepted, especially in the eyes of an auditor. So, a best practice in accepting risk would be to make sure there is a relatively formalized and documented process to evidence justification.

All of these risk handling factors could work together in various ways to determine how and why your inherent risk is reduced and residual risk is determined. There are dozens of very different methodologies and calculations as well as opinions on what is and isn’t adequate for reducing risk. It’s common for third-party risk management to focus so much on a vendor’s controls that they forget other ways of reducing risk, such as incorporating internal controls, establishing good contract terms or simply avoiding risk that isn’t necessary. When you diversify your risk handling methods through various internal controls, your third-party risk management program will perform to its full advantage.

Now that you understand how to get from inherent to residual risk, check out this infographic to further understand what the differences are between them. Download the infographic.

.gif?width=1920&name=Sample-Graphic-Animation%20(1).gif)